Property tax estimator

The Fizber Property Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in any city nationwide. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

Property Tax How To Calculate Local Considerations

The Linn County Assessor may provide property information to the public as is without warranty of any kind expressed or implied.

. We can only provide estimates for the counties listed in the drop-down menu. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

This calculator is designed to estimate the county vehicle property tax for your vehicle. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. We are accepting in-person online and mail-in property tax payments at this time.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The Estimator Program also cannot. 218 E McCollum Avenue Bushnell Florida 33513.

In cases where the property owner pays their real estate taxes into an escrow account their mortgage company should request the tax bill. If you have questions about the. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County.

Your county vehicle property tax due may be higher or lower depending on other. Rates include the 1 property tax administration fee. The information presented on this site is collected organized and provided for the convenience of the user and is intended solely for informational purposes.

The calculator should not be used to determine your actual tax bill. Start Your Homeowner Search Today. Assessed values are subject to change by the assessor Board of Review or State Equalization process.

Ad The Ultimate Solution for Property Investors Realtors Mortgage Brokers. Your information will be updated regularly during. Find All The Record Information You Need Here.

Property Tax Estimator Property Tax Estimator. Rates include special assessments levied on a millage basis and levied in all of a township city or village. Those who may have just purchased a home or recently applied for homestead exemptions may find this tool especially useful.

Our property tax estimator is a great way to estimate your property taxes for the upcoming year. Get an estimate of your property taxes using the calculator below. Homestead Exemption and Portability.

Excluding Los Angeles County holidays. All figurescalculations based on the 2021 tax year These are estimates ONLY - not exact amounts. The actual tax amount for this property may be more or less depending on a variety of factors including changes to the millage tax rate and the inclusion of non-ad valorem assessments eg.

Choose a city from the drop down box enter a propertyprice in the space provided then press the Calculate button. Ad Get In-Depth Property Tax Data In Minutes. This estimated calculation applies only to residential properties Class 01 for the tax year.

Legal The various Divisions of the Department of Treasury are guided by State statutes Administrative Rules Court cases Revenue Administrative Bureau Bulletins Property Tax Commission Bulletins and Letter Rulings. Vehicle Property Tax Estimator Please enter the following information to view an estimated property tax. Ad Enter Any Address Receive a Comprehensive Property Report.

This Tax Estimator is a tool for prospective home buyers for estimating what the taxes will be on a particular piece of property. Such As Deeds Liens Property Tax More. Residential Other Residential Non-Residential Farmland Multi-use Annexed The residential property assessment class includes single-family homes condominiums townhouses and other properties of three or fewer.

Taxpayer Rights Remedies. Statutory exemptions including revitalization exemptions may affect the taxable values. Unsure Of The Value Of Your Property.

Exemptions. Use this estimator tool to determine your summer winter and yearly tax rates and amounts. See the online functions available at the Property Appraisers Office.

See Results in Minutes. More Tax Roll Administration. Internal Policy Directives are prepared to provide guidance to department staff to insure uniformity in tax administration.

The County is committed to the health and well-being of the public. This property tax estimator can help you see how much a property of a certain value is required to pay in property taxes this year. 830 AM - 500 PM Mon-Fri.

Using the property tax estimator tool is easy as 1-2-3. The tax rates calculated using the Property Tax Estimator Program may change once taxing authorities budgets are certified in September. Property Tax General Information PDF Resources Forms.

The results displayed are the estimated yearly taxes for the property using the last. Rates also include special assessments levied. You will need your property tax folio number to apply.

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. Census Bureau American Community Survey 2006-2010. The tax roll is then certified by the Property Appraiser to the Tax Collector who in turn mails the tax noticereceipt to the owners last address of record as it appears on the tax roll.

Hanahan City of Charleston Town of Jamestown Town of Bonneau Town of St Stephen Town of Moncks Corner City of Goose Creek North Charleston Goose Creek Parks and Playgrounds Sangaree Special District Town of Summerville. To estimate your municipal taxes enter the property assessment values from your BC Assessment Notice in the boxes below. Estimated Property Tax.

2015 Jasper County SC All Rights Reserved Created by Vision Internet - Innovators of Online GovernmentVision Internet - Innovators of Online Government. School District 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills 41130 - Grandville 41145 - Kenowa Hills 41160 - Kentwood. If you attempt to use the link below and are unsuccessful please try again at a later time.

Propstream Alone Has Helped My Real Estate Investment Business Scale Jerome C. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. Type in your homes market value.

Search Valuable Data On A Property. Census Bureau American Community Survey 2006-2010. Property Tax Estimator Notice The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

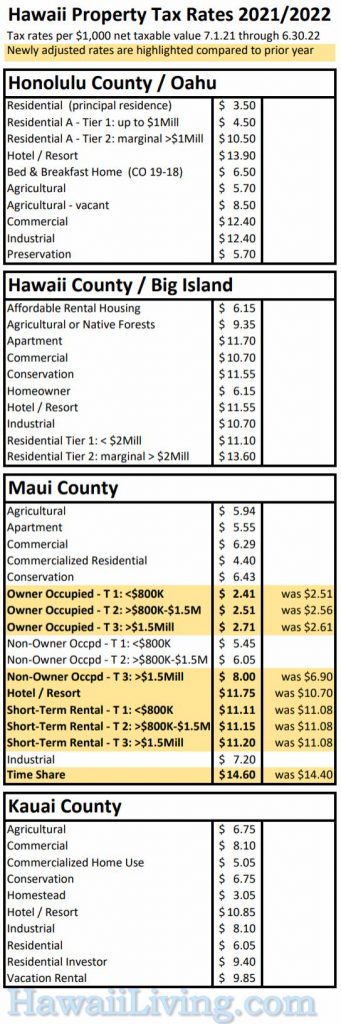

New Hawaii Property Tax Rates 2021 2022

Kansas Property Tax Calculator Smartasset

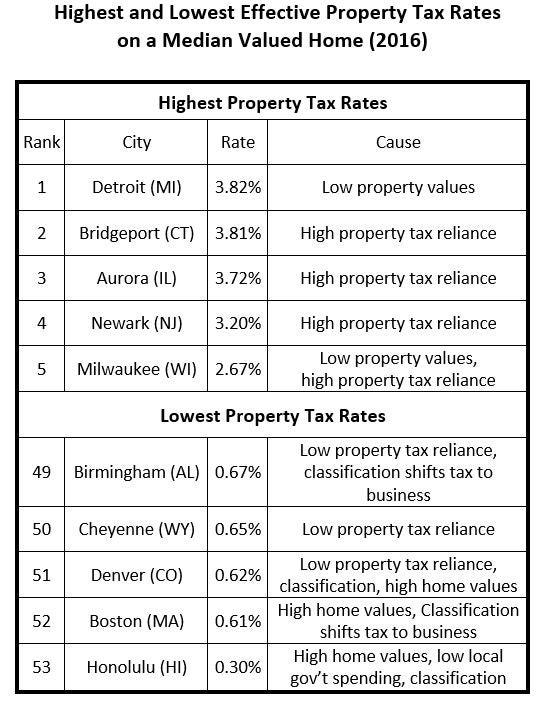

States With The Highest And Lowest Property Taxes Property Tax Tax States

Real Estate Property Tax Constitutional Tax Collector

Property Taxes Property Tax Analysis Tax Foundation

Property Tax Calculator How Property Tax Works Nerdwallet

The Property Tax Equation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Real Property Tax Howard County

Property Taxes Property Tax Analysis Tax Foundation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Secured Property Taxes Treasurer Tax Collector

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Property Taxes Property Tax Analysis Tax Foundation

Harris County Tx Property Tax Calculator Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation